Organize your finances and be the boss of your money, not the other way around.

I used to know nothing about money, my only rule was to pay the bills first and spend the rest.

When I moved to England I had to learn to manage my money and soon I realised that my bad money habits were anxiogenic and not sustainable.

I have never been told anything about how to organize personal finances, and how important this was for my overall health.

I started studying myself, and through many tests, I found what works for me and I will show in this guide what I did and still do to organize finances while living abroad to have some peace of mind.

Why organizing your finances is so important?

- Money problems can affect your mental health: issues related to money can trigger anxiety, and it affects sleep, relationships and overall health.

- It gives you the power and you will feel empowered

- It helps you to save money: savings can give you freedom and improve your quality of life

- Finance organization helps you get out of debt quicker

- It reduces stress

How to organize your finances?

- Build awareness and start tracking

- Choose a tool and have a money date with your finances

- Separate per category

- Start saving and build your emergency fund

- Enjoy your peace of mind, think about investing and setting systems

- Quick summary

- References

1. Build awareness and start tracking

“The first element of change is awareness. You can’t change something unless you know it exists.”

T. Harv Eker – the secrets of a millionaire mind

If you want to change your financial situation this is the first step, stop avoiding to look your finances and start now.

- What are your current thoughts about money?

- How do you feel about money?

- What actions are you taking with your money? Maybe you are overspending? Or self-sabotaging? Or trying to impress people by buying things you don’t even need?

- What results are you having with the previous actions? Debt, anxiety, stress?

Easier ways to track your finances (only free options): every time you spend/earn any money you add the date, value and name using the tool of your preference:

- Notes app on your phone

- Digital spreadsheet using the Notion App

- Any small notepad and carry it with you everywhere

Do this for 30 days, try not to miss any days, and if you do, go back and add in your spending tracker.

At the end of your 30 days, you will have a look and highlight expenses per category.

- Use a different highlight colour for each category: for example green for fixed expenses, pink for self-care, yellow for food, etc.

- Where are you spending most of your money?

- Did you notice any patterns? For example: during your PMS you tend to buy things you don’t need to soothe yourself.

Take some time to reflect on that, awareness is the first step toward changing behaviours.

2. Choose a tool to organize and have a money date with your finances

Do you prefer to do your financial planning on paper or using an app?

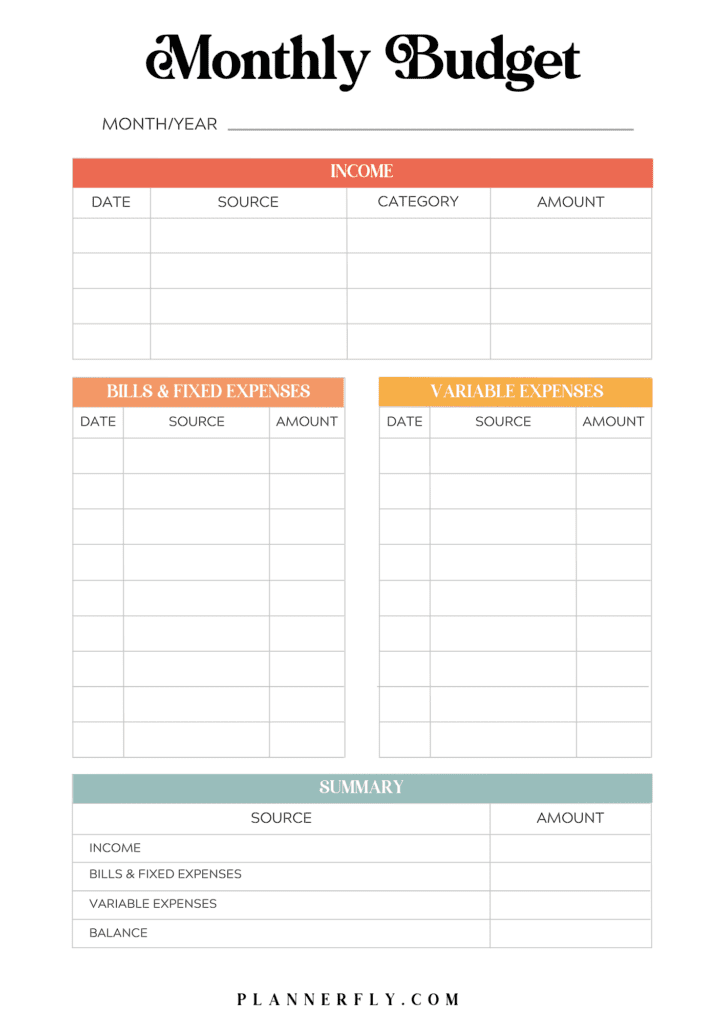

Don’t worry because you don’t need those complex excel sheets. I will give you some options but feel free to adapt as you like.

Here are some tools to organize your finances:

- Use any notebook you have at home and create your own “template”.

- A notion template where you can add all your expenses, income sources, and savings trackers, all in one place and your phone – it’s my personal choice. I designed an all-in-one notion template that includes a simple budget template on it, check here.

- Invest in a budget planner

Money Date

Schedule on your calendar to check your finances, this does not need to be dragging. Go for a coffee on a Sunday morning and get your finances in check.

I do this twice a month, generally on a Sunday morning, whilst listening to music and having a fresh coffee. It takes around 40 minutes.

3. Organize your finances per category

Creating categories makes it easier to visualize where your money is going and build awareness of your financial life.

For expenses, here are some categories you can use on your finance planner:

- Bills

- Food

- Personal

- Transport

- Subscriptions

- Entertainment

It’s also good to separate your fixed expenses into one table/page.

A fixed expense just means an expense in your budget that you can expect to stay the same, or close to it, over time. Ex: rent, mortgage, utility bills, gym membership, phone bills and loan payments.

Other categories to organize your finances:

- Debt

- Savings

Keep in mind that you can add or exclude any categories as you like, this is just a guide to help you to start. With time you will find out what works better for you.

It’s important not to overwhelm yourself, try to keep it simple and enjoyable.

4. Start saving and build your emergency fund

By organizing your finances and becoming aware of where your money is going you can now decide how much are you able to save each month.

If you are in debt, make it your priority to get out of it.

But I like to have savings, regardless of debt. But let’s focus on savings here.

What is an emergency fund?

An emergency fund is a stash of money set aside to cover the financial surprises life throws your way. These unexpected events can be stressful and costly.

Here are some of the top emergencies people face:

- Job loss.

- Medical or dental emergency.

- Unexpected home repairs.

- Car troubles.

- Unplanned travel expenses.

Source: Vanguard

I also like to think about this as an opportunity fund, so if a great opportunity comes up, like the possibility to rent a bigger house or changing your car, you have the money ready for it.

This is especially important for us that live abroad and don’t have any family around to support us.

You need to be your cushion, you can’t rely on other people when you are thousands of miles from your family and with other currency.

I can’t stress how important having an emergency fund is and the impact it had on my overall life and kept me sane even during the pandemic.

How to start building an emergency fund:

- Decide on how much you are going to save each month to build your emergency fund.

- To make it easier for you, automate this payment, and set a direct debit on your account, this way you don’t have to make a decision to save and you will be less tempted to spend that money.

- Start by saving at least one month of expenses: this will give you some time to breathe and will create momentum. For example: if the costs of your monthly expenses are around £1000, do your best to save your first £1000 in a separate savings account.

- Then, aim for saving 6 months of expenses.

- After that, you can start studying investing.

5. Enjoy your peace of mind and Automate your finances

There is nothing like going to bed and sleeping soundly without having to worry about your credit card, if you have enough money to pay the rent next month, or if you can afford a dinner out with a friend.

Having an emergency fund gives you peace.

It also gives you freedom.

When you have money in your savings to afford your living costs for a few months, this gives you the freedom to choose to take some risks.

Maybe you want to change jobs or start a side hustle.

During the pandemic, I and my husband managed to move from a shared house to a lovely bedroom flat right in town.

I also changed jobs in the middle of the pandemic.

Later I cut my hours on my job to learn graphic design and start freelancing.

I would never risk any of those things If I didn’t have an emergency fund to give me some sense of security.

We have to remember that we are emotional creatures with emotional needs. By creating safety with our money, we can reduce stress around money and start actually living.

Set automatic payments

Start saving and changing bad money habits are hard, but you can make this process smoother by automating it.

Decide which bills are you automating and how much are you saving each month and set up an automatic payment.

This will only take a few minutes to set up and removes so much friction.

6. Quick summary

- Build awareness and start tracking to learn more about your money habits.

- Choose a tool and have a money date to keep yourself accountable with your finances and money goals.

- Separate per category, expenses, debt, savings and other categories.

- Start saving and build your emergency fund.

- Enjoy your peace of mind, and learn about investing and setting systems to make it easier for you.

I hope this helps you to get started, but don’t wait to take action, now it’s the perfect time to start.

Take what resonates with you and just start, adapt and learn what works along the way.

Your future self will thank you for it.

Download your monthly budget template for free and start organizing your finances today.

Remember to manage your money like a boss, not the other way around.

7. References

“The psychology of money: timeless lessons on wealth, greed, and happiness”.